BTC

$107,446.83

–

0.36%

ETH

$2,448.34

–

1.67%

USDT

$1.0004

–

0.00%

XRP

$2.0966

–

4.31%

BNB

$645.77

–

0.03%

SOL

$141.10

–

2.70%

USDC

$0.9999

–

0.01%

TRX

$0.2712

+

0.08%

DOGE

$0.1614

–

2.11%

ADA

$0.5568

–

2.60%

HYPE

$36.87

–

1.20%

WBT

$47.66

–

0.50%

BCH

$494.97

–

1.09%

SUI

$2.6418

–

3.17%

LINK

$13.12

–

1.78%

LEO

$9.0088

+

0.18%

AVAX

$17.45

–

1.19%

XLM

$0.2342

–

3.20%

TON

$2.8356

–

0.45%

SHIB

$0.0₄1129

–

3.13%

By Shaurya Malwa, CD Analytics

Updated Jun 27, 2025, 5:30 a.m. Published Jun 27, 2025, 5:30 a.m.

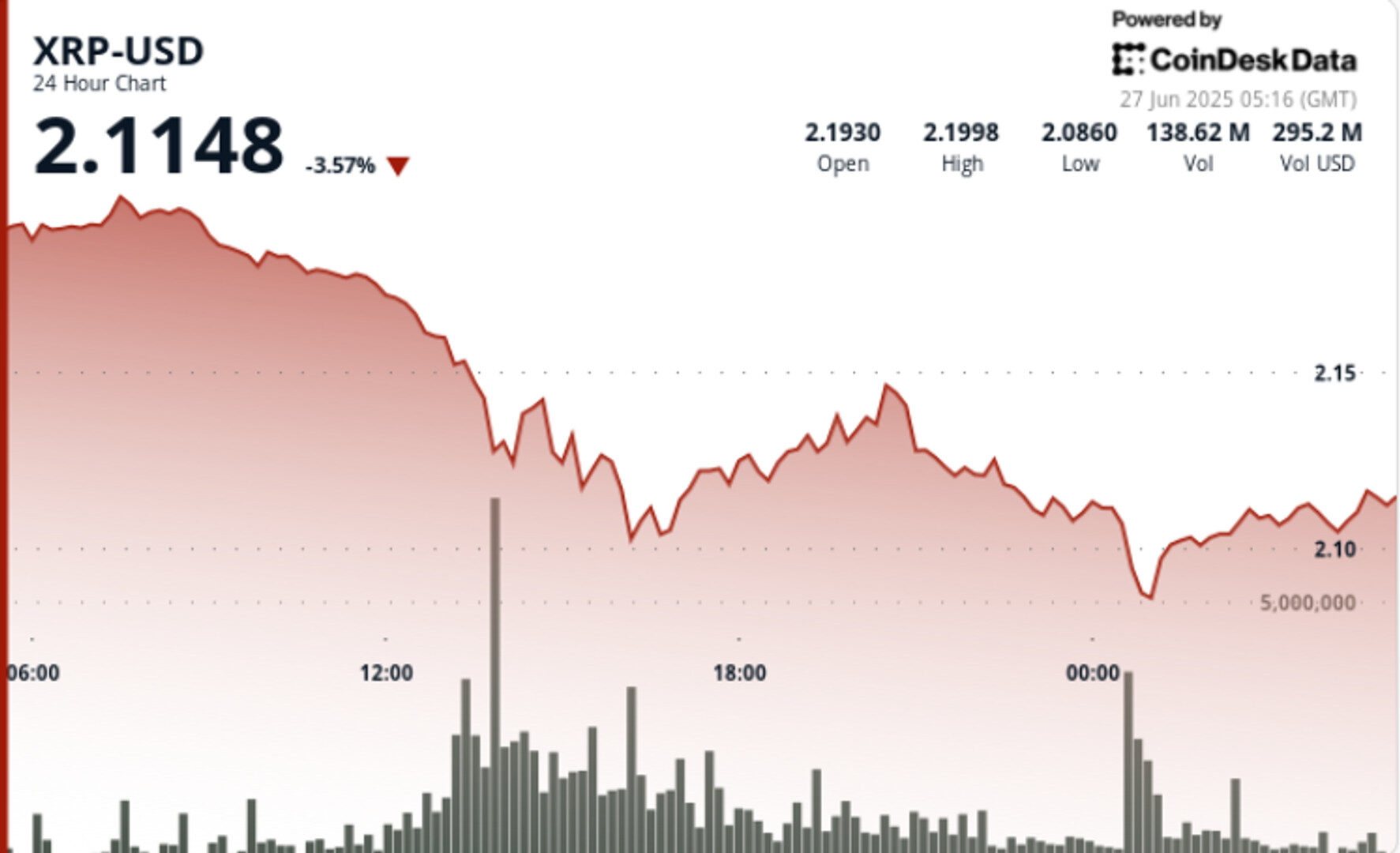

- XRP fell 5.3% to $2.10 despite easing geopolitical tensions and significant whale activity.

- Ripple’s transfer of $439 million in XRP and other large movements raised questions about potential distribution.

- Technical resistance at $2.17 and support at $2.08-$2.09 indicate ongoing bearish momentum.

XRP faced sharp downside pressure over the last 24 hours, falling 5.3% despite large-scale whale activity and easing geopolitical tensions.

The asset dipped from $2.21 to a session low of $2.08 before a modest recovery to $2.10.

While the broader crypto market attempted to stabilize following ceasefire agreements in the Middle East, XRP’s momentum remained fragile, with technical resistance building at $2.17.

- Market sentiment improved slightly after former U.S. President Donald Trump reportedly helped broker a ceasefire between Iran and Israel, calming some investor fears.

- Despite that, XRP struggled to hold recent gains as traders reacted to large on-chain movements. Ripple transferred $439 million worth of XRP to an unknown wallet, and other whale wallets moved another $58 million to centralized exchanges — raising questions about potential distribution or internal reshuffling.

- Although these events drew attention, the token’s inability to reclaim $2.14 resistance signals underlying bearish momentum.

- Technical analysts continue to monitor XRP’s descending channel pattern, with expectations for a breakout or breakdown between July and September. For now, the $2.08-$2.09 zone remains a critical level to hold.

XRP dropped from $2.21 to $2.10 over the 24-hour period, marking a 5.3% decline within a $0.13 range. The steepest selloff occurred between 12:00 and 16:00 UTC on June 26, with back-to-back hourly volume surges above 99 million XRP as price fell to $2.10. Resistance formed clearly at $2.17, with multiple rejection wicks above $2.12 later in the session.

STORY CONTINUES BELOW

By midnight UTC, XRP had revisited its session low of $2.08. A modest bounce followed in the final hour of the session, as price climbed from $2.09 to $2.10, with short-lived momentum topping at $2.105. A drop in volume late in the session suggests buyer fatigue, though the $2.08 support zone held firm.

• XRP declined 5.3% from $2.21 to $2.10, with a total intraday range of $0.13

• Heaviest selling occurred from 12:00–16:00 UTC on volume over 114M and 99M XRP

• Strong resistance formed at $2.17; key support tested at $2.08–$2.09

• Recovery attempts failed at $2.14 and $2.12 before settling around $2.10

• Final hour showed modest 0.54% gain from $2.09 to $2.10, with volume spiking to 930K XRP during 01:42–01:45

• Consolidation near $2.10 in final 15 minutes suggests short-term stabilization

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.