The move came amid renewed U.S.–China tariff fears and cautious positioning ahead of next week’s SEC deadlines for spot XRP ETFs.

By Shaurya Malwa, CD Analytics

Updated Oct 18, 2025, 6:19 a.m. Published Oct 18, 2025, 6:19 a.m.

• XRP traded defensively, recovering from an early dip to $2.19 as institutional buyers absorbed selling pressure.

• Trading volume surged to 246.7M, nearly triple the 24-hour average, as sellers capitulated near $2.23.

• The SEC’s review of six pending spot XRP ETF filings continues, with Ripple planning a $1B treasury raise.

XRP traded defensively but held key supports Friday, recovering from an early dip to $2.19 as institutional buyers absorbed selling pressure. The move came amid renewed U.S.–China tariff fears and cautious positioning ahead of next week’s SEC deadlines for spot XRP ETFs.

What to Know

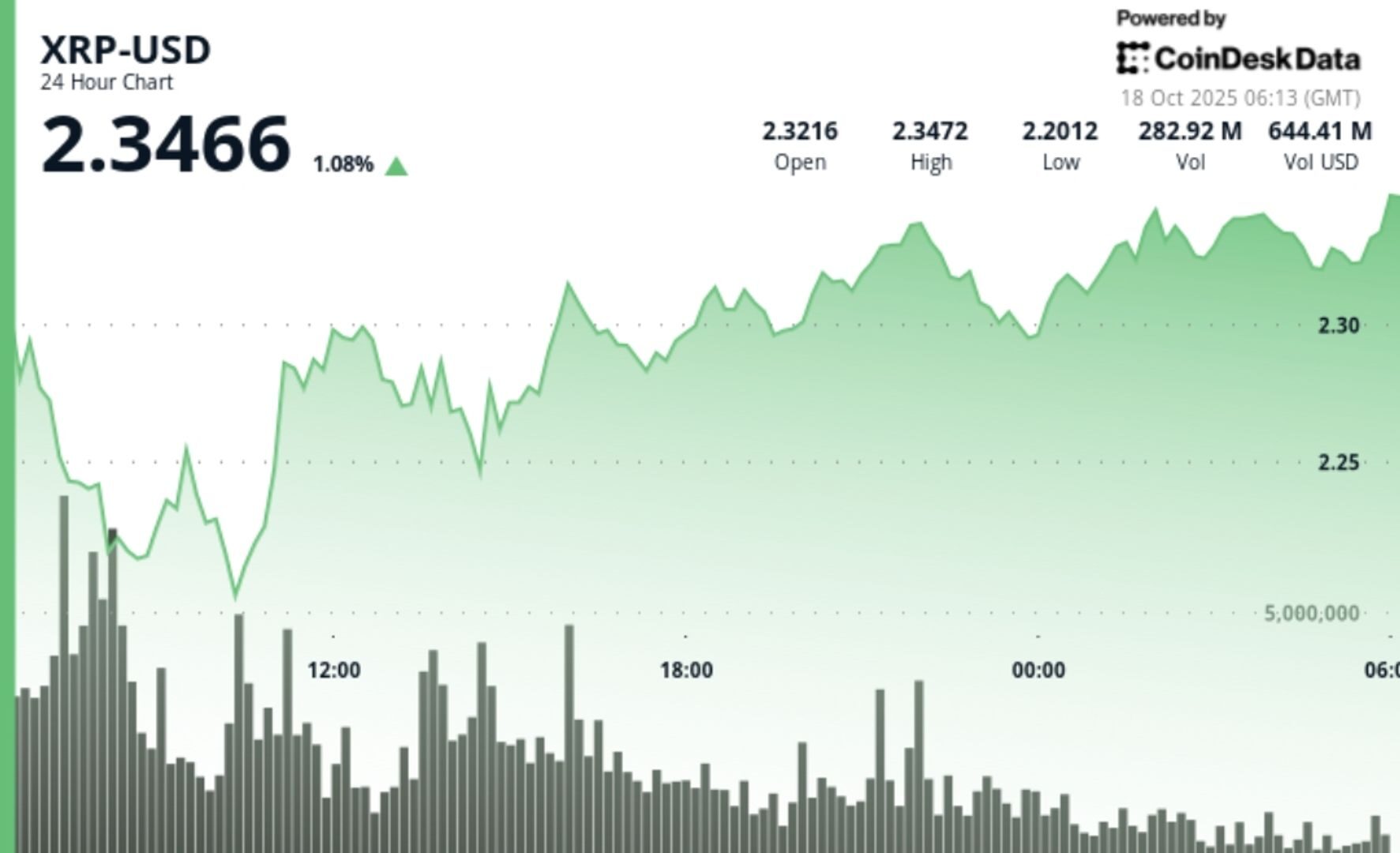

• XRP oscillated between $2.19 and $2.35 over the 24-hour session from Oct 17, 06:00 to Oct 18, 05:00 — a 7% range.

• Trading volume hit 246.7M during the 07:00 hour, nearly triple the 24-hour average, as sellers capitulated near $2.23.

• Price recovered from a $2.19 low to settle at $2.33, logging a 1% gain from the session open.

• Broader crypto market cap dropped 6% to $3.5T as macro tensions and U.S.–China trade rhetoric spurred risk-off flows.

• SEC review of six pending spot XRP ETF filings continues through Oct 25, alongside Ripple’s planned $1B treasury raise.

News Background

The early-session decline mirrored weakness across the digital asset complex as investors reduced exposure ahead of trade-related headlines and ETF deadlines. Despite a sharp morning drawdown from $2.33 to $2.19, XRP stabilized quickly as market depth recovered on strong buy programs. Ripple’s $1B fundraising initiative for its treasury division bolstered confidence, while analysts framed the move as “controlled rotation” rather than structural weakness.

Price Action Summary

• XRP dropped to $2.19 at 07:00 UTC on 246.7M volume, setting key intraday support.

• Bulls regained control through mid-session, driving a steady climb to $2.33–$2.35 resistance.

• The final 60 minutes (04:22–05:21 UTC) saw a minor flush to $2.32 followed by a rebound to $2.33 (+1.8%), with 1.69M in peak tick volume.

• Consolidation between $2.32–$2.34 formed the new short-term base, validating strong absorption near prior lows.

Technical Analysis

• Support – $2.23–$2.25 remains the key accumulation zone; sub-$2.20 exposure continues to attract long interest.

• Resistance – $2.35–$2.38 intraday band caps upside; breakout confirmation needed above $2.40.

• Volume – Peak at 246.7M during selloff; late-hour surges (~1.7M) signal return of liquidity.

• Trend – Gradual upward bias after morning flush; RSI neutral, MACD stabilizing.

• Structure – Short-term consolidation within $2.19–$2.35 suggests reaccumulation ahead of potential ETF headline catalysts.

What Traders Are Watching

• ETF approval window (Oct 18–25) and potential market repricing once SEC determinations land.

• Whether $2.30 holds as base support through weekend trading.

• Continuation of Ripple’s $1B treasury raise and potential secondary-market implications.

• Broader risk sentiment as tariff escalation dampens altcoin liquidity.

• Technical breakout above $2.40 as signal for rotation back toward $2.70–$3.00 range.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Shaurya Malwa, CD Analytics

2 hours ago

The session’s 7% swing came amid renewed macro jitters and reports of large whale liquidations totaling over $74 million.

What to know:

• Dogecoin stabilized within a $0.18–$0.19 range after early volatility saw prices drop to $0.176.

• Large holders liquidated $74 million in Dogecoin amid broader market declines due to tariff concerns.

• Trading volumes peaked at 1.4 billion, establishing strong support near $0.18.