-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Share this article

Token rebounds from session lows with whale accumulation offsetting institutional liquidations, but resistance levels cap momentum.

By Shaurya Malwa, CD Analytics

Updated Sep 4, 2025, 5:03 a.m. Published Sep 4, 2025, 4:58 a.m.

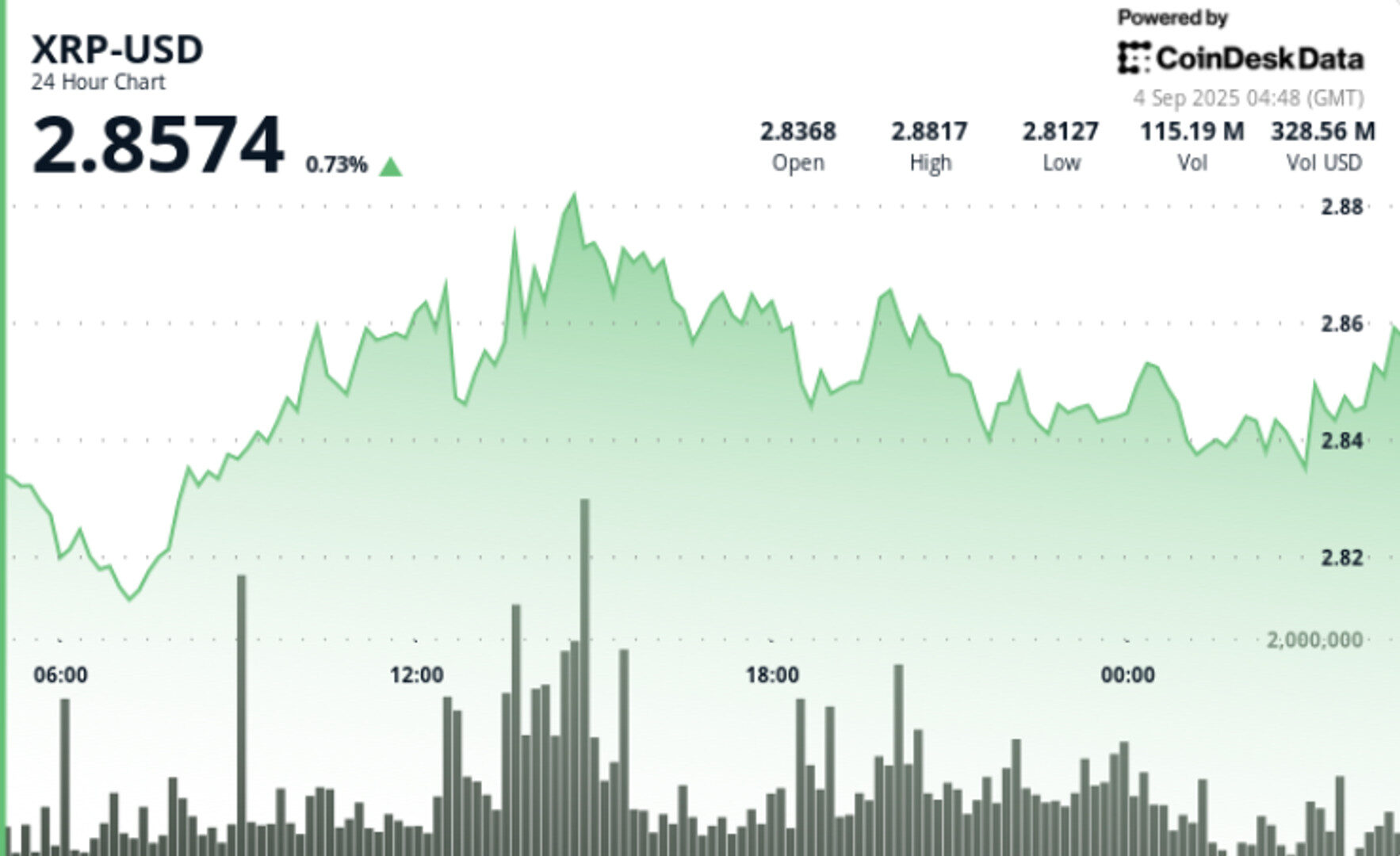

- XRP traded in a narrow range from $2.81 to $2.87 over a 24-hour period, with large wallets accumulating 340 million XRP despite significant institutional liquidations.

- Total transaction volume on the XRP Ledger more than doubled on September 1, reaching 2.15 billion XRP.

- Analysts are divided on XRP’s future, with some predicting a rise to $7–$13 and others warning of resistance below key trendlines.

- XRP traded in a narrow 2% range from $2.81 to $2.87 during the 24h session from Sept. 2 at 14:00 to Sept. 3 at 13:00.

- Large wallets accumulated roughly 340M XRP (~$960M) over the past two weeks even as institutions liquidated ~$1.9B since July.

- Total transaction volume across the XRP Ledger reached 2.15B XRP on Sept. 1, more than double typical daily activity.

- Analysts remain split: some highlight long-term bullish structures (symmetrical triangles, Elliott Wave counts) with upside toward $7–$13, while others warn of fading momentum below multi-year resistance trendlines.

- XRP opened near $2.84 and closed at $2.85, up slightly despite intraday volatility.

- Price dipped early from $2.84 → $2.79, then rebounded to $2.87 by midday on Sept. 3.

- Support developed at $2.82, repeatedly attracting bids.

- Resistance capped upside near $2.86, where distribution pressure intensified.

- Final-hour trading saw a reversal: a spike to $2.873 (12:38 GMT) on 5.38M volume was rejected, pushing price back under $2.85.

- Support: $2.82 zone remains the key demand area. Below that, $2.70 and $2.50 are next.

- Resistance: $2.86–$2.88 continues to act as overhead supply. $3.00 is the psychological hurdle, with $3.30 as breakout confirmation.

- Momentum: RSI steady in mid-50s, showing neutral bias with slight bullish lean.

- MACD: Histogram converging toward bullish crossover, signaling momentum could strengthen if volume persists.

- Patterns: Symmetrical triangle consolidation under $3.00 intact. Break above $3.30 unlocks higher targets.

- Volume: Session surges (93M–95M vs 44M avg) point to active institutional flows.

- Whether $2.82 support holds under renewed pressure.

- A decisive close above $2.86–$2.88, then $3.00 and $3.30 for a breakout setup.

- Whale flows: continued accumulation versus ongoing institutional selling.

- Regulatory and macro catalysts, including Fed policy and pending SEC clarity, which could shift sentiment quickly.

More For You

By Shaurya Malwa, CD Analytics

46 minutes ago

Dogecoin defends $0.214 support while ETF speculation drives heightened trading activity.

What to know:

- DOGE advanced 4% over a 24-hour period, with trading volumes significantly exceeding the average.

- Analysts are divided on DOGE’s future, with some predicting a decline and others forecasting a potential rise.

- Key support and resistance levels are at $0.214 and $0.223, with institutional activity influencing price movements.