BTC

$108,177.74

–

0.80%

ETH

$2,519.94

–

1.57%

USDT

$1.0002

–

0.00%

XRP

$2.2308

–

0.24%

BNB

$655.77

–

0.40%

SOL

$147.60

–

3.25%

USDC

$1.0000

+

0.01%

TRX

$0.2836

–

0.81%

DOGE

$0.1641

–

2.68%

ADA

$0.5791

–

1.41%

HYPE

$39.46

+

1.35%

SUI

$2.8950

–

2.56%

WBT

$44.78

+

3.01%

BCH

$485.72

+

0.46%

LINK

$13.19

–

2.26%

LEO

$9.0263

–

0.07%

AVAX

$17.79

–

3.26%

XLM

$0.2380

–

0.58%

SHIB

$0.0₄1154

–

1.41%

TON

$2.7408

–

2.54%

By Shaurya Malwa, CD Analytics

Updated Jul 5, 2025, 5:29 a.m. Published Jul 5, 2025, 5:29 a.m.

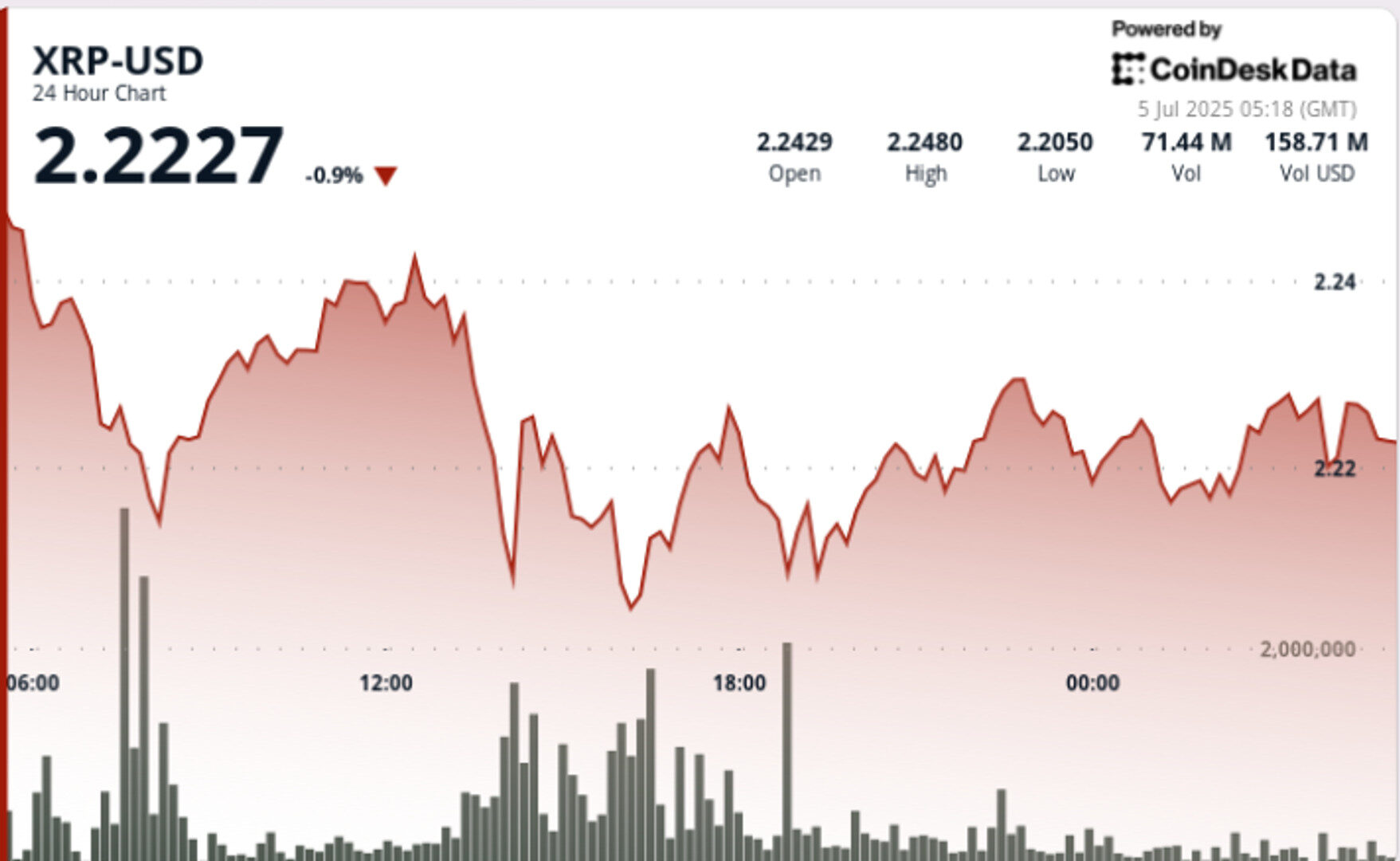

- XRP has shown signs of consolidation, pulling back 1.07% amid global economic uncertainty while maintaining key support above $2.20.

- Ripple’s application for a U.S. bank license and ETF speculation are bolstering XRP’s long-term sentiment despite macroeconomic pressures.

- Analysts suggest XRP could reach $10 with sustained institutional adoption and regulatory advancements, as it is increasingly considered for CBDC bridge infrastructure.

XRP showed signs of consolidation over the past 24 hours as the cryptocurrency pulled back slightly from recent highs, shedding 1.07% amid ongoing global economic uncertainty.

Despite the dip, price action remains constructive with higher lows forming above $2.20 — a level that has emerged as key short-term support.

While macro headwinds continue to pressure digital assets broadly, XRP’s bullish structure and rising institutional narrative, including Ripple’s U.S. bank license application and ETF speculation, are keeping long-term sentiment intact.

- The cryptocurrency market remains on edge as geopolitical and trade tensions between major economies continue to cloud investor confidence.

- However, XRP’s long-term outlook is bolstered by Ripple’s ongoing push for regulatory clarity and deeper financial integration.

- The firm’s recent application for a U.S. national banking license with the OCC, alongside a separate bid for a Federal Reserve master account, could unlock direct access to the Fed’s payment systems — a groundbreaking development for a crypto-native firm.

- Analysts also point to structural bullish signals, with XRP forming higher highs and higher lows across multiple timeframes.

- Momentum could further accelerate if Ripple secures ETF approval or regulatory breakthroughs, particularly as XRP is increasingly eyed for CBDC bridge infrastructure by more than 50 countries.

- A potential move to $10 — or even higher — is being discussed by market observers, contingent on sustained institutional adoption and market alignment.

• XRP experienced a notable downtrend over the last 24 hours from 4 July 03:00 to 5 July 02:00, declining from $2.243 to $2.219, representing a 1.07% decrease with a trading range of $0.052 (2.32%).

STORY CONTINUES BELOW

• The asset encountered strong selling pressure during the 07:00 and 14:00 hours, with volume spikes exceeding 56 million units, establishing key support at $2.209 where buyers consistently emerged.

• A temporary recovery attempt occurred between 21:00-22:00 with price climbing to $2.230 on above-average volume, but momentum failed to sustain, suggesting continued bearish sentiment.

• In the last 60 minutes from 5 July 01:06 to 02:05, XRP experienced a notable decline of 0.35%, dropping from $2.225 to $2.217.

• A significant sell-off occurred at 01:12 where price fell to $2.221 on volume exceeding 418,000 units.

• The asset found temporary support at $2.216 around 01:29 before staging a recovery attempt at 01:59 with the highest volume spike of nearly 249,000 units, pushing price to $2.219.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.