Share this article

Traders should watch for XRP to maintain support around $2.60-$2.63, as a sustained rise above $2.65 could shift the bias bullish.

By Shaurya Malwa, CD Analytics

Updated Oct 29, 2025, 5:24 a.m. Published Oct 29, 2025, 5:24 a.m.

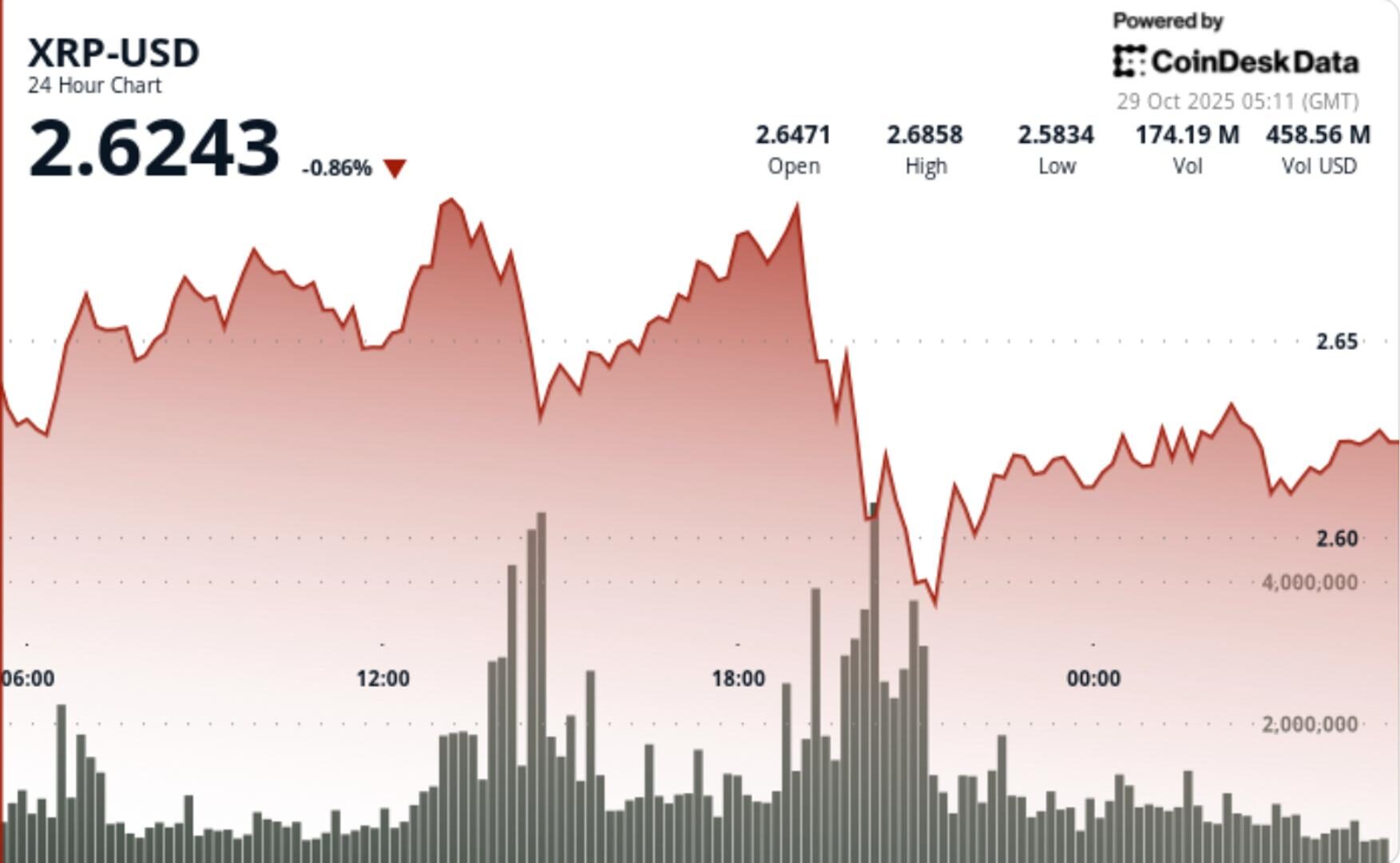

- XRP rose 0.60% to $2.623 as trading volume increased by 47% above its seven-day average, signaling heightened institutional interest.

- Despite bullish patterns, XRP faces resistance near $2.68, with momentum indicators suggesting possible short-term consolidation.

- Traders should watch for XRP to maintain support around $2.60-$2.63, as a sustained rise above $2.65 could shift the bias bullish.

XRP advanced modestly as trading activity spiked, though momentum indicators warn of near-term consolidation risk.

- XRP climbed 0.60% to $2.623 while trading volume surged about 47% above its seven-day average, indicating increased institutional interest amid a lack of strong breakout catalysts.

- The token still faces resistance from a rejection near $2.68 and multiple analysts caution that while bullish chart patterns exist, the recent momentum may be capped.

- Over the session, XRP traded in an $0.11 range, oscillating between ~$2.64 and ~$2.62.

- A peak volume of ~167.3 million tokens (≈140% above the 24-hour average) was recorded during the failed breakout near $2.68 resistance.

- The $2.60 psychological support level held firm through several tests. This price action reflects controlled accumulation rather than a full breakout run.

- The breakout attempt above $2.68 was rejected, confirming that resistance remains stiff.

- The support zone at ~$2.60 has demonstrated resilience, yet momentum indicators—such as the TD Sequential—have triggered caution signals.

- Chart structure shows consolidation between $2.60 and $2.67, which may form the base of a future move but also warns of possible short-term pause.

- Volume surge validates interest but the lack of a clean breakout suggests the move is still in setup mode.

- Traders should monitor whether XRP can hold the support band around $2.60-$2.63.

- A sustained close above $2.65 coupled with renewed volume would tilt the bias bullish and open targets near $2.70-$2.90.

- Conversely, a break below ~$2.60 would expose a retest of ~$2.55 or lower.

- The upcoming ETF decision window and institutional inflows remain key catalysts to watch.

More For You

Oct 16, 2025

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

By Omkar Godbole|Edited by Sam Reynolds

47 minutes ago

Record XRP and Solana futures activity pushed open interest on the derivatives giant’s platform to roughly $3 billion, signaling renewed retail and institutional appetite for altcoin exposure.

What to know:

- CME-listed futures for XRP and Solana reached record open interest, indicating strong demand for regulated crypto products.

- The notional open interest for these futures contracts totaled $3 billion, highlighting their growing popularity among investors.

- Solana futures launched in March and surpassed $1 billion in open interest by August, while XRP futures achieved this milestone within three months of their debut.