-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 21, 2025, 3:56 p.m. Published Aug 21, 2025, 3:56 p.m.

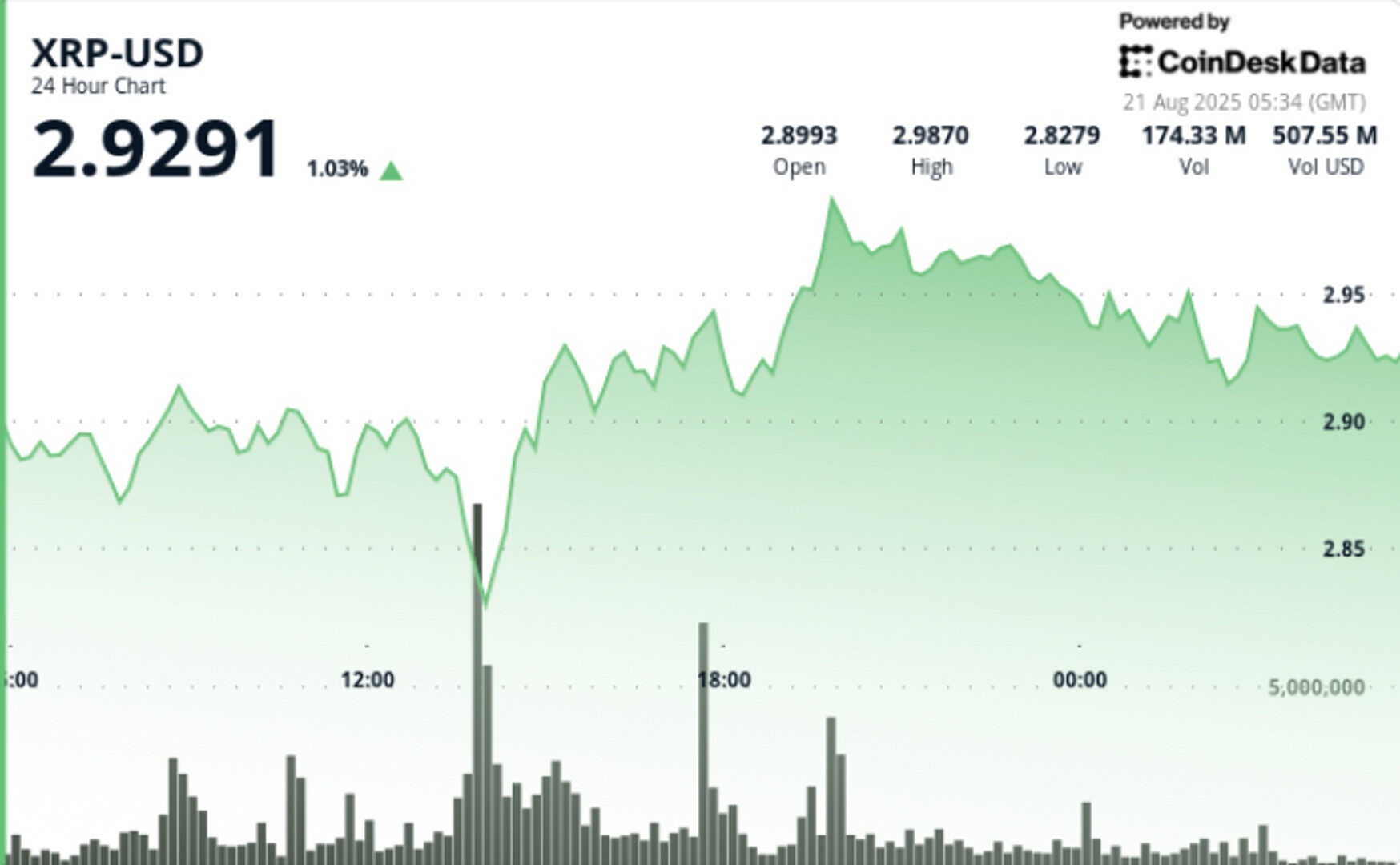

- XRP rallied towards $3, with trading volume increasing by over 6% above its weekly average, indicating renewed institutional interest.

- The token faces a strong resistance at the $3 mark, despite a significant price swing between $2.84 and $2.99.

- Traders are closely monitoring whether the $2.93 support level will hold or if a break above $3 will trigger further upward momentum.

XRP rallied toward the $3 mark in the past session, with trading volume spiking more than 6% above its weekly baseline.

• XRP’s rally comes amid broader crypto stabilization, with altcoins tracking modest inflows after last week’s drawdown.

• On-chain data flagged institutional-sized flows, with nearly 155 million in XRP turnover during recovery periods, far above the 63 million daily average.

• Market chatter initially suggested XRP was hitting new highs, though the actual all-time peak remains $3.84 from January 2018 — underscoring that this is a recovery test, not price discovery.

STORY CONTINUES BELOW

• XRP swung 5.1% between $2.84 and $2.99 in the 23-hour window from Aug. 20 13:00 to Aug. 21 12:00.

• The strongest push came around 19:00 UTC on Aug. 20, when the token surged from $2.84 to $2.99 on 80.6 million volume.

• Subsequent sessions showed consolidation, with repeated bounces in the $2.89–$2.93 range, confirming it as interim support.

• A sharp whipsaw in the final hour (Aug. 21 11:03–12:02) saw an 8.6% swing: from $2.916 to $2.901 on 960,000 units, before stabilizing.

• Support: $2.89–$2.93 zone shows multiple strong bounces on above-average participation.

• Resistance: $2.99–$3.00 psychological ceiling caps momentum; repeated rejections visible.

• Volume: 80.65 million during the rally vs. a 24-hour baseline of ~63 million.

• Pattern: Sideways consolidation following bullish impulse; momentum tilting slightly downward.

• Whether $2.93 support holds in the short term or gives way to a retest of $2.82.

• Break above $3.00 as a potential trigger for trend continuation.

• Volume sustainability — if flows taper, bulls risk losing control.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

38 minutes ago

The data currently on hand does not support the case for lowering interest rates, said the president of the Cleveland Fed.

What to know:

- Cleveland Fed President Hammack says the data do not support the case for a rate cut.

- Her remarks suggest Chairman Powell continues to have support at the central bank for his hawkish stance.

- Bitcon fell to a session low following the comments.