XRP Price Analysis: Ripple Clean Technical Break Repositions Bulls for $2.80 Push

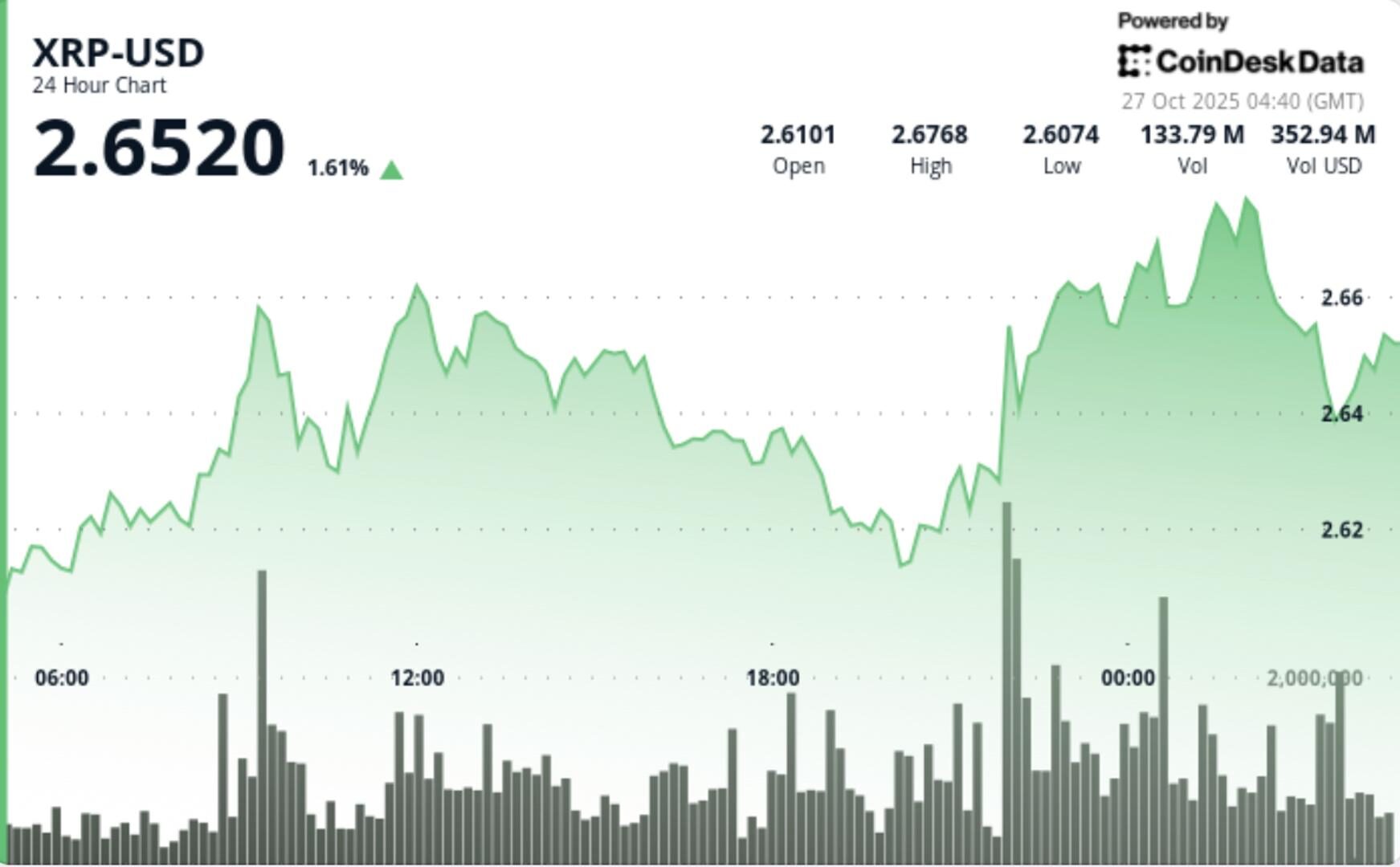

XRP surged 3% to $2.68 during Sunday’s session, breaking above the critical resistance level at $2.63 on a dramatic volume spike — one of the largest of the month.

Updated Oct 27, 2025, 4:48 a.m. Published Oct 27, 2025, 4:48 a.m.

- XRP surged 3% to $2.68, breaking above the critical resistance level at $2.63 with significant trading volume.

- Institutional interest and upcoming regulatory developments are driving the current momentum in XRP.

- Traders are monitoring whether XRP can maintain its support at $2.63 and if volume remains high to support further gains.

XRP climbed from $2.60 to $2.68, clearing the $2.63 barrier and establishing new support between $2.61-$2.63.

- XRP surged 3% to $2.68 during Sunday’s session, breaking above the critical resistance level at $2.63 on a dramatic volume spike — one of the largest of the month.

- The breakout aligns with growing institutional interest, backed by recent commentary from fund managers noting “hundreds of millions” flowing into XRP-exposure vehicles.

- The move also comes ahead of expected regulatory and ETF developments, which many analysts believe could accelerate demand.

- XRP climbed from $2.60 to $2.68, clearing the $2.63 barrier and establishing new support between $2.61-$2.63.

- Trading volume hit approximately 106.5 million units in a single breakout hour — a 147% increase above the prior 24-hour average.

- The token traded in a tight $0.08 range, illustrating disciplined accumulation rather than erratic speculation.

- Price action was characterized by higher lows that reinforced the breakout structure, and late-session consolidation near $2.67 suggested buyers were defending gains rather than exiting.

- The structure now defines a breakout above a multi-session resistance zone with strong volume confirmation, a textbook signal of institutional accumulation.

- Support at $2.61-$2.63 is newly anchored, while immediate resistance lies in the $2.70-$2.75 area.

- Volume patterns confirm the move: large spike at breakout, followed by lower volatility during consolidation, pointing toward absorption. Key momentum indicators (RSI, MACD) remain constructive on daily charts, aligning with broader breakout psychology.

- Traders are now watching two critical behaviours: First, whether XRP can hold the $2.63 support base; a re-test and hold would validate the breakout.

- Second, if volume remains elevated or picks up again, the breakout has higher-probability extension toward the $2.70-$2.75 zone.

- On-chain flows and institutional product commentary (e.g., remarks from Teucrium Trading executives about large inflows) support the accumulation narrative.

- On the risk side, a sustained close below $2.61 would undermine the breakout and could trap price back in its prior consolidation range.

More For You

Stablecoin payment volumes have grown to $19.4B year-to-date in 2025. OwlTing aims to capture this market by developing payment infrastructure that processes transactions in seconds for fractions of a cent.

More For You

35 minutes ago

BTC looks north as Fed rate cut looms. But one key resistance is yet to be cleared.

What to know:

- BTC moves above key average hurdle as Fed rate cut looms.

- CoinDesk’s BTI continues to signal downtrend.

- Prices are yet to top the Ichomoku cloud.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language