Filecoin (FIL) Trades Little Changed, Underperforms Wider Crypto Markets

A technical consolidation pattern emerged as trading activity surged nearly 50% above weekly averages.

By CD Analytics, Will Canny|Edited by Jamie Crawley

Dec 10, 2025, 1:12 p.m.

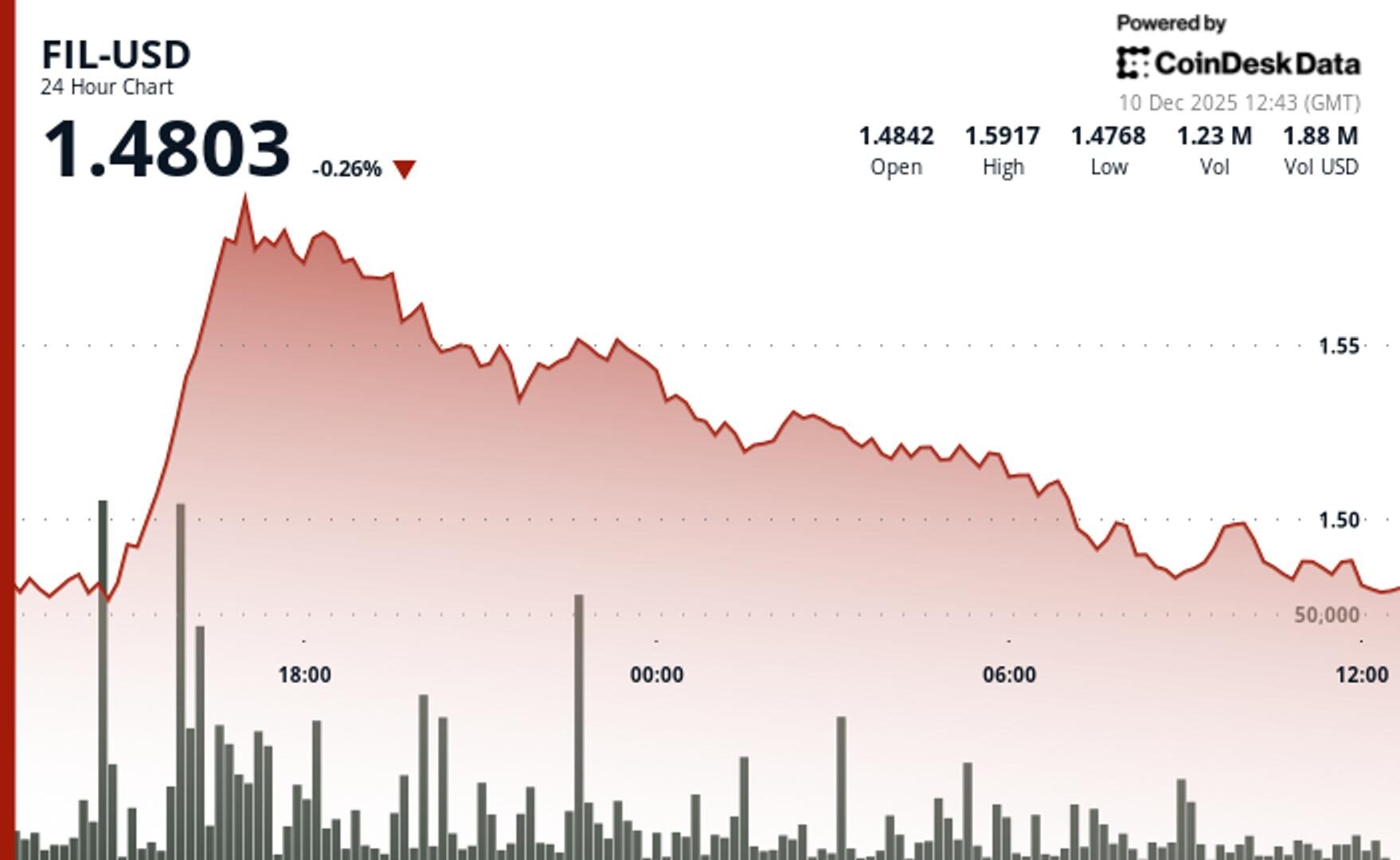

- FIL slipped 0.3% to $1.48 with volume 50% above the weekly average.

- FIL consolidated with an $0.11 range representing 7.5% of the token’s value.

- The token has support at the $1.48 level and resistance at $1.59.

Filecoin FIL$1.4875 slipped 0.3% to $1.48 over the last 24 hours, as the token underperformed wider crypto markets.

The broader market gauge, the CoinDesk 20 index, was 2.2% higher at publication time.

STORY CONTINUES BELOW

FIL consolidated with an $0.11 range representing 7.5% of the token’s value, according to CoinDesk Research’s technical analysis model.

The critical development emerged from Filecoin’s relative weakness against broader crypto markets, the model said.

The volume surge proved particularly significant, with activity breaching thresholds that typically accompany larger price moves.

The disconnect between elevated volume and modest gains often signals distribution patterns, the model showed, where sellers meet increased demand at current levels, creating equilibrium between competing forces.

- Critical support holds at $1.48 with consistent demand zone validation

- Strong resistance confirms at $1.59 following Dec. 9 volume spike

- 24-hour activity exceeds 7-day average by 50%, indicating institutional interest

- Volume spikes above 150,000 tokens per minute coincide with $1.48 support tests

- Declining channel forms with lower highs from $1.58 to $1.49 following surge

- Volatile consolidation establishes 7.5% range over 24-hour period

- Upside targets $1.49 resistance with extension potential toward $1.59

- Downside risk limited by proven demand at $1.48 support level

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

By CD Analytics, Will Canny|Edited by Stephen Alpher

20 minutes ago

The token has support at the $2.19 level and resistance at $2.39.

What to know:

- DOT climbed from $2.13 to $2.21 in the last 24 hours.

- An exceptional volume surge of 15.89M tokens drove a breakout attempt before momentum faded.

- The token consolidated around the $2.19-$2.20 zone with resistance capping gains near $2.39.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language