Custodia asks full appeals court to reconsider Fed master account denial

The Wyoming-based cryptocurrency bank argued that the three-judge panel undermined state banking authorities, raising “serious constitutional questions”

By Olivier Acuna|Edited by Jamie Crawley

Dec 16, 2025, 12:18 p.m.

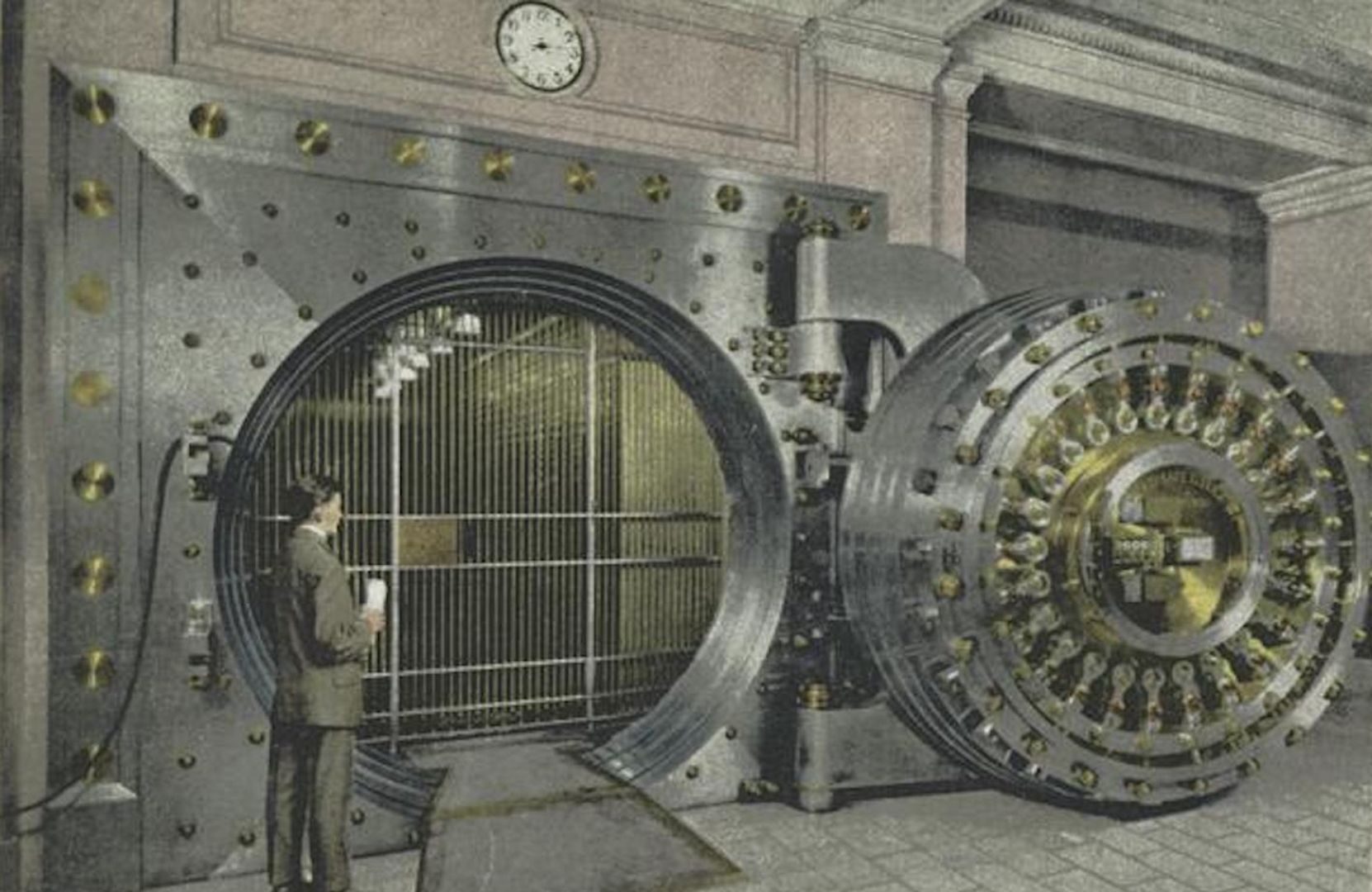

- Custodia Bank has filed a petition for a rehearing en banc with the Tenth Circuit Court of Appeals in its legal battle against the Federal Reserve.

- The bank argues that the Fed’s denial of a master account undermines state banking authority and raises constitutional concerns.

- The October ruling against Custodia is a significant setback in its efforts to gain access to the U.S. payments system.

Wyoming-based crypto bank Custodia filed a new petition in its long-running legal battle against the Federal Reserve for access to a master account, requesting a rehearing en banc before the full Tenth Circuit Court of Appeals.

Custodia Bank is asking the court to reconsider its October ruling that sided with the Fed in denying the bank access to core central bank payment services, in a fight that has become a pacesetter for crypto banking access to the U.S. payments system.

STORY CONTINUES BELOW

In the petition for rehearing en banc filed on Dec. 15, Custodia is urging all active judges on the court, not just the original three-judge-panel, to revisit the October decision that upheld the Fed’s authority to deny master accounts even to state-chartered, federally supervised banks.

Custodia argued that the three-judge panel’s ruling improperly vests the Fed with “unreviewable discretion” over access to core payment infrastructure, undermining state banking authority and raising “serious constitutional questions” by entrusting that power to officials not appointed as officers of the United States under Article II of the Constitution.

The petition also argued that the panel misread the Monetary Control Act, which states that Federal Reserve services “shall be available” to eligible depository institutions. The bank contends the ruling improperly converts that language into optional discretion, allowing regional Federal Reserve banks to effectively override state banking charters.

The October ruling marked another setback for Custodia, which has litigated its exclusion from the Fed’s payment infrastructure since it first sued the Federal Reserve in 2022. Whether the full Tenth Circuit agrees to rehear the case remains uncertain, but the petition ensures the debate over crypto banks’ access to the financial plumbing is far from over.

More For You

Nov 14, 2025

What to know:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

More For You

30 minutes ago

The proposals outline a “similar approach” to regulating crypto as in TradFi, echoing the U.K. Treasury’s intention to extend financial rules to crypto.

What to know:

- The U.K.’s FCA is seeking feedback on proposed cryptocurrency rules under a new regulatory framework.

- The proposals outline a “similar approach” to regulating crypto as in traditional finance.

- Responses to the FCA’s consultation are open until Feb. 12, 2026.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language