-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Share this article

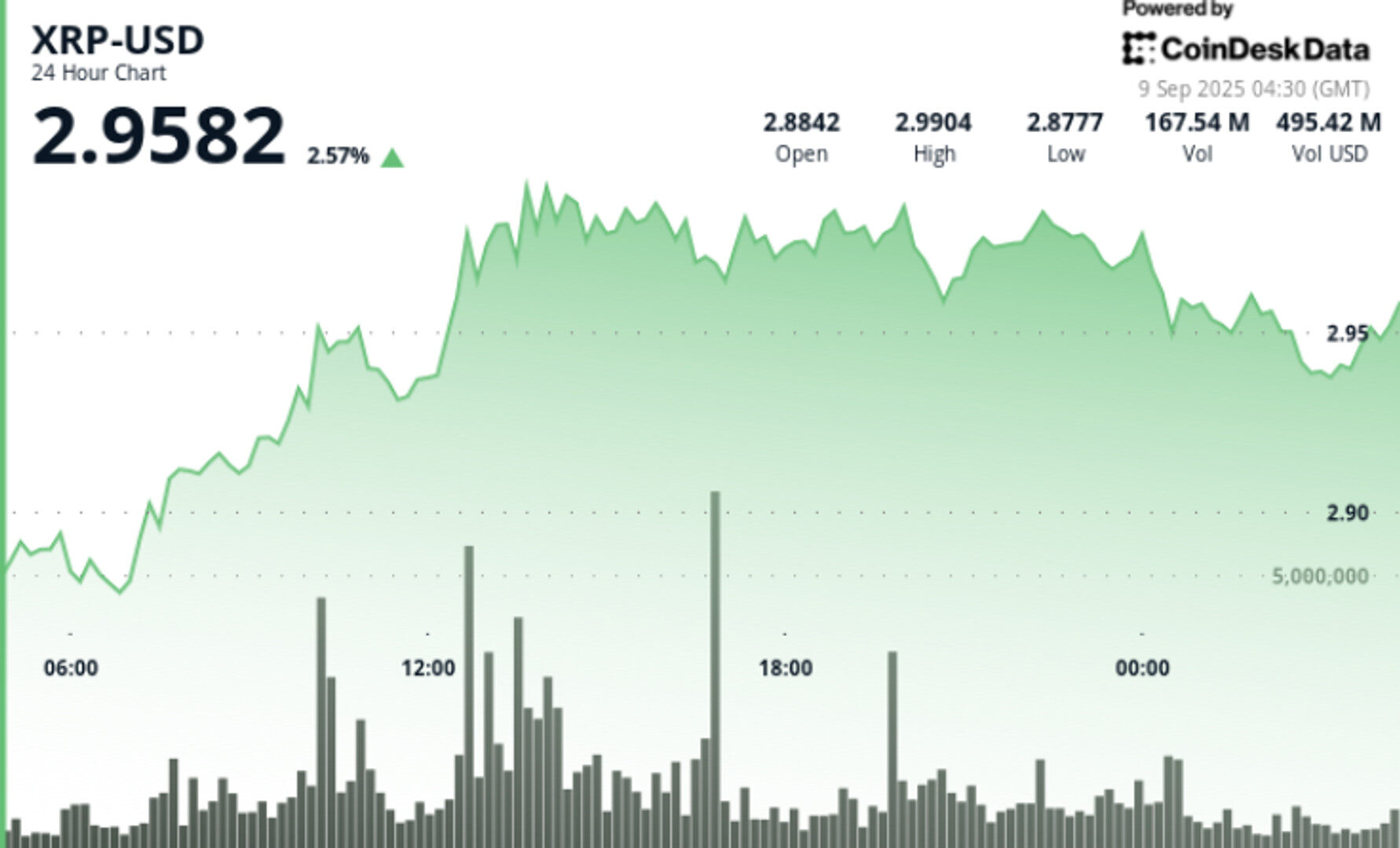

Support has held firm above $2.88, but repeated failures near $2.99 highlight how institutional flows are dictating short-term ranges.

By Shaurya Malwa, CD Analytics

Updated Sep 9, 2025, 4:38 a.m. Published Sep 9, 2025, 4:38 a.m.

- XRP rallied towards $3.00 on high volume but faced resistance, with support holding above $2.88.

- Federal Reserve futures indicate a 99% chance of a rate cut, boosting crypto as a dollar-weakening trade.

- Six XRP ETF applications are pending SEC review, potentially impacting institutional access and demand.

The digital asset rallied toward the $3.00 threshold on explosive volume before consolidating, as traders positioned around upcoming macro catalysts and ETF rulings. Support has held firm above $2.88, but repeated failures near $2.99 highlight how institutional flows are dictating short-term ranges.

- Federal Reserve futures now imply a 99% chance of a 25-bps cut on September 17, boosting crypto as a dollar-weakening trade.

- Exchange reserves rose to a 12-month peak, signaling more supply on exchanges even as whales accumulated an estimated 10M XRP in 15 minutes during the breakout.

- Six spot XRP ETF applications are pending SEC review in October, a structural catalyst traders are monitoring.

- Session ran from September 8 04:00 to September 9 03:00.

- XRP advanced from $2.89 to $2.995 intraday (+4%) before closing at $2.95.

- Volume spiked to 159.63M at 13:00—nearly 3x daily norms—confirming institutional participation.

- Support held multiple times at $2.88–$2.89, while $2.995–$3.00 was repeatedly rejected.

- Final hour saw a grind higher: $2.94 → $2.95 (+0.34%) on 1.6M volume, with higher lows showing controlled accumulation.

- Support: $2.88–$2.89 zone continues to attract buyers.

- Resistance: $2.995–$3.00 ceiling remains intact after multiple high-volume rejections.

- Momentum: RSI steady in mid-50s = neutral-to-bullish bias.

- MACD: Histogram converging toward bullish crossover, consistent with accumulation.

- Pattern: Price compressing within a consolidation channel under $3.00. A confirmed close above $3.00–$3.05 could target $3.30–$3.50.

- Ability to close above $2.99–$3.00. Bulls want a clean daily settlement above the zone to flip resistance into support.

- Fed meeting on Sept. 17. A 25-bps cut is fully priced; anything larger or delayed could alter crypto liquidity expectations sharply.

- Whale inflows. Roughly 340M tokens reportedly accumulated in recent weeks. Traders are gauging whether this continues into ETF decision season.

- SEC’s October ETF rulings. Six applications, including from Grayscale and Bitwise, could transform institutional access and reprice XRP’s structural demand.

More For You

By Shaurya Malwa, CD Analytics

25 minutes ago

Early momentum carried price to a $0.244 peak, but heavy profit-taking reversed gains by session close at $0.236.

What to know:

- Dogecoin experienced significant volatility, with heavy trading volumes near the $0.234 support level.

- Despite early gains, Dogecoin faced resistance at $0.244, leading to a session close at $0.236.

- Institutional interest remains high, with traders watching for regulatory developments and the Fed’s upcoming rate decision.