-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 18, 2025, 1:34 p.m. Published Aug 18, 2025, 1:34 p.m.

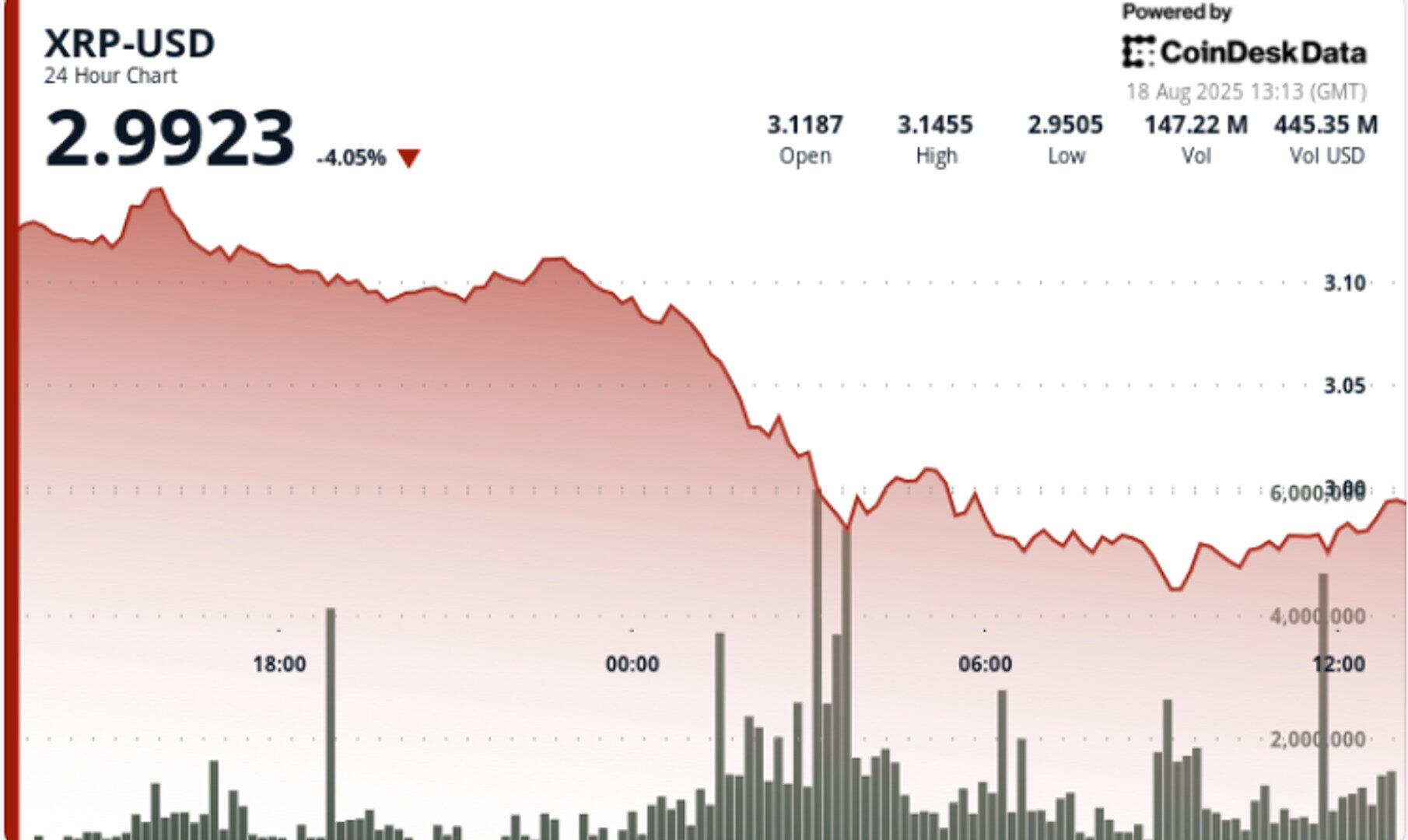

- XRP experienced a sharp decline, falling 5.4% to $2.97 as retail selling surged.

- Whale investors absorbed the dip, purchasing 440 million XRP despite the retail selloff.

- A potential breakout could occur if XRP surpasses the $3.08–$3.14 resistance zone.

XRP slid to $2.97 in its sharpest decline in weeks, shedding 5.4% over a 23-hour stretch as retail selling overwhelmed order books.

The move came on surging volumes that eclipsed daily averages, but whale wallets quietly absorbed the dip — scooping 440 million tokens worth $3.8 billion. The divergence between retail capitulation and institutional accumulation sets up a pivotal point around the $3.00 mark.

• XRP fell from $3.14 to $2.97 in under 24 hours, posting its steepest pullback since July.

• Whale buyers added 440 million XRP even as retail traders dumped holdings.

• A symmetrical triangle pattern has formed, with a breakout target near $3.90 if resistance clears.

• Broader crypto markets saw correlated weakness amid rising risk-off sentiment.

STORY CONTINUES BELOW

• XRP lost 5.41% in the 23-hour window ending August 18 at 08:00.

• The heaviest selling came between 01:00–03:00, with $3.08 to $2.97 collapse on 172 million volume.

• Final hour saw muted recovery attempt, lifting XRP from $2.97 to $2.98.

• Trading halted in the last four minutes of the session, suggesting closure or data disruption.

• Resistance is clustered at $3.08–$3.14, the zone that capped recovery attempts.

• Support has shifted to $2.96–$2.97, where whales absorbed supply.

• A symmetrical triangle points to $3.90 upside target if $3.26 breaks.

• Golden cross emerged last week, but the signal has yet to trigger follow-through.

• Volatility remains elevated, with $0.18 intraday range and 163% spike in volume versus averages.

• Whether whales continue absorbing dips near $3.00 support.

• Breakout or rejection at $3.08–$3.14 resistance zone.

• Impact of halted trading in final minutes — market glitch or structural weakness.

• Continuation of broader market selloff or stabilization.

• Confirmation of the triangle breakout toward $3.90 or breakdown below $2.96.

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

1 hour ago

The news comes alongside Fluidstack exercising its option to expand at WULF’s Lake Mariner data center campus.

What to know:

- AI cloud platform Fluidstack is exercising its option to expand at TeraWulf’s Lake Mariner data center campus.

- Alongside, Google (GOOG) will add $1.4 billion to its backstop of the project’s debt financing in return for warrants to buy another 32.5 million of WULF shares.

- After soaring more than 50% on the original Fluidstack/Google news last week, WULF is higher by another 10% premarket.