-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Events -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

By Shaurya Malwa, CD Analytics

Updated Aug 19, 2025, 5:26 a.m. Published Aug 19, 2025, 5:25 a.m.

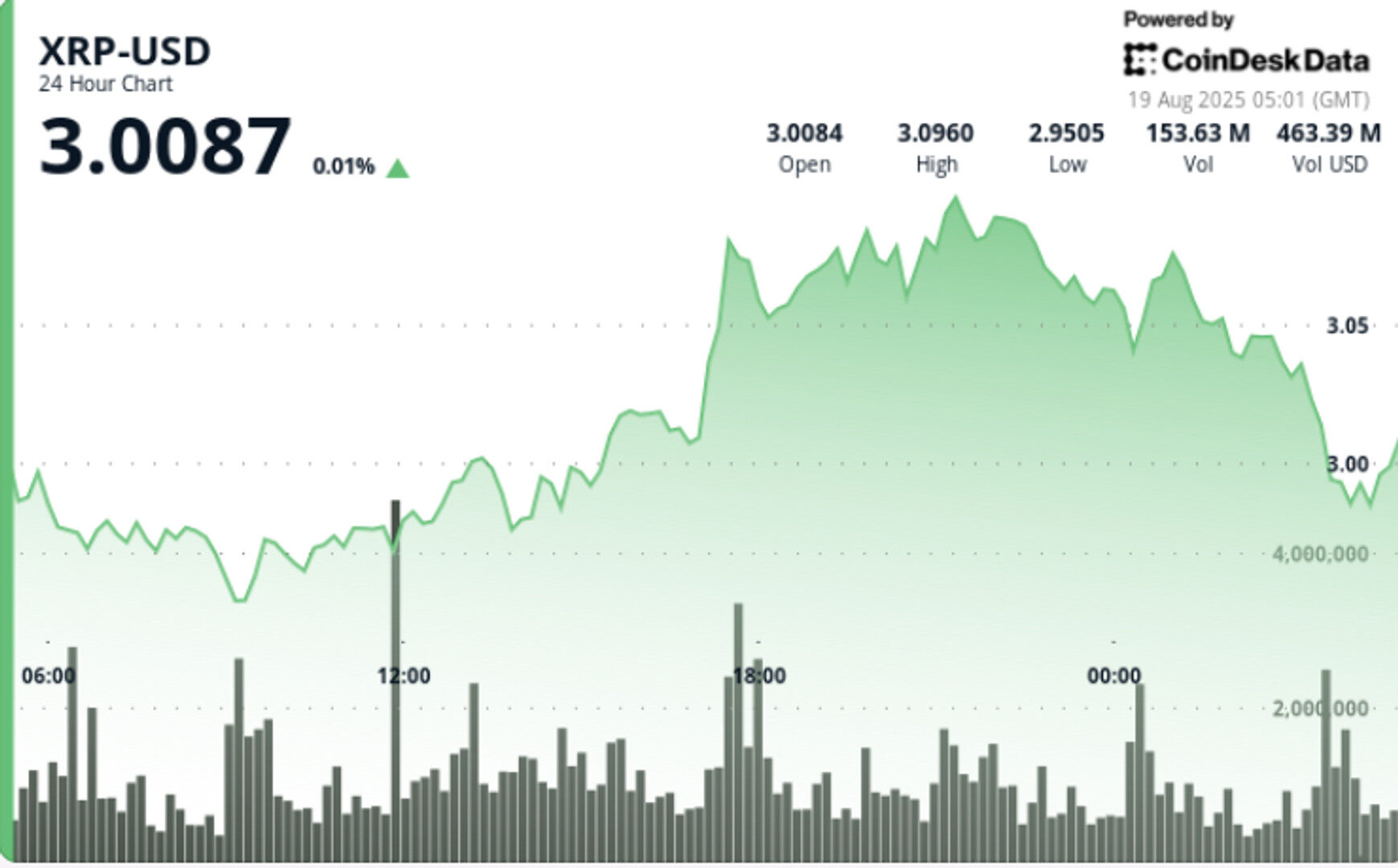

- XRP ended Monday’s session near the $3.00 mark after a sharp selloff in the final trading hour, indicating institutional distribution.

- The token experienced nearly 4% intraday volatility, with a bullish surge pushing prices to $3.10 before momentum faded.

- Key resistance at $3.09 and support at $3.00 highlight potential for either a retest of higher levels or a deeper correction.

XRP closed Monday’s session under pressure, reversing an earlier rally and ending near the $3.00 threshold. A sharp selloff in the final trading hour saw the asset dip 1% on surging volume, suggesting institutional distribution and stop-loss liquidations driving price action.

XRP traded within a $0.11 range between $2.94 and $3.10 across the 24-hour session from August 18 05:00 to August 19 04:00, representing nearly 4% intraday volatility. A bullish breakout during the 17:00 trading hour on August 18 pushed prices from $2.97 to $3.10, supported by heavy volume of 131 million—double the 24-hour average of 66.8 million. This established short-term support near $3.00.

STORY CONTINUES BELOW

Momentum faded quickly, however. The token rejected multiple times at $3.09, sliding into consolidation around $2.99. An aggressive pullback unfolded during the 03:00 hour on August 19, when XRP dropped from $3.04 to $2.99.

• XRP declined 1% in the final 60 minutes, sliding from $3.03 to $2.99 as volumes spiked to 5.26 million—five times the hourly average

• Distribution pressure accelerated around the $3.00 psychological threshold, triggering stop-loss liquidations during the 03:43–03:46 interval

• A bullish surge earlier in the session (August 18 17:00) lifted XRP from $2.97 to $3.10 on 131 million volume, far above average activity

The late-session breakdown confirmed institutional selling near $3.00, erasing the earlier breakout’s momentum. While $2.99 provided intraday stabilization, the volume-backed rejection at $3.09 highlights growing resistance pressure.

XRP now sits at a crossroads: holding above $2.99 could allow bulls to retest the $3.08–$3.09 cluster, while failure risks a deeper correction toward the $2.96 demand zone.

• Range: $0.11 (3.8%) between $3.10 peak and $2.94 trough

• Resistance: $3.09, rejected repeatedly through evening sessions

• Support: $3.00 psychological level, tested under high-volume distribution

• Risk: Breakdown toward $2.96 demand zone if $2.99 fails

• Signal: Bullish triangle structure intact, but momentum fading under profit-taking

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

By Sam Reynolds, AI Boost|Edited by Parikshit Mishra

1 hour ago

The move follows a confidential SEC submission earlier this month and comes amid a surge of digital asset firms tapping the equity markets.

What to know:

- Figure, a blockchain lender founded by SoFi co-founder Mike Cagney, has filed for an IPO amid a surge in crypto offerings.

- The company plans to list its shares on Nasdaq under the ticker FIGR, with major banks like Goldman Sachs as lead underwriters.

- Financials reveal a 22.4% revenue increase in the first half of 2025, with net income of $29 million, marking a turnaround from a loss the previous year.